The Coldwell Banker Commercial® brand(CBC) is a worldwide leader in the commercial real estate industry, and is part of the oldest and most respected national real estate brand in the country, Coldwell Banker Real Estate. Coldwell Banker Commercial is an Anywhere (NYSE: HOUS) brand, a global leader in real estate franchising and provider of real estate brokerage, relocation and settlement services.

Summer is peak season for commercial real estate leasing, with tenant tours, lease signings, and site activations surging across sectors from healthcare to retail. CRE professionals who act now can capitalize on seasonal momentum, secure prime space, and stay ahead of Q4 competition.

As data centers drive commercial real estate demand, power access—not financing or location—is emerging as the top dealbreaker. With grid delays, rising energy costs, and a looming 32-gigawatt shortfall, CRE professionals must prioritize energy strategy to secure sites, protect timelines, and unlock long-term value.

Coldwell Banker Commercial Realty is pleased to announce the $4,990,000 sale of The Somerset Apartments in San Francisco. The 18-unit apartment complex is located at 3835 19th Street, in the Dolores Heights neighborhood.

Here’s a two-sentence, SEO-optimized description for your article on AI in commercial real estate:

Artificial intelligence is transforming commercial real estate by streamlining site selection, enhancing investment strategy, and improving development planning with real-time data insights. From predictive analytics to ESG risk modeling, AI is now an essential tool for CRE professionals seeking a competitive edge in a volatile market.

In 2025, the U.S. commercial real estate market shows cautious optimism with rising transaction volumes and stabilized interest rates, but faces a looming $957 billion refinancing wall and growing distress. From Nashville’s office market struggles to strategic investor implications, this midyear outlook highlights key risks and opportunities shaping CRE’s path forward.

As of mid-2025, commercial real estate is outperforming residential housing in total returns, driven by resilient income and evolving asset strategies. Principal Asset Management’s latest report highlights CRE’s rare divergence from housing trends and forecasts a strong decade ahead for investors.

In this episode, Josh Best interviews Alex Vidal, the president of ERA Real Estate, discussing his extensive journey in the real estate industry, leadership philosophies, and the importance of coaching and mentorship. Alex shares insights from his early days as a secretary to becoming a leader in the real estate sector, emphasizing the significance of leading by example and the role of continuous learning in achieving success. In this conversation, Alex Vidal shares insights on leadership, focusing on key goals for growth, building a positive organizational culture, and identifying talent beyond traditional resumes. He emphasizes the importance of accountability, personal growth outside the real estate industry, and the significance of morning routines for success. Alex also discusses the balance between giving freedom to team members and holding them accountable, while highlighting the need for a strong team to achieve ambitious goals.

Coldwell Banker Commercial's Ryan Pilsy brokers $3.35M sale of 3.5-acre TOD-zoned land in Charlotte for a 200-unit affordable housing project by The Annex Group. Learn more about this impactful development.

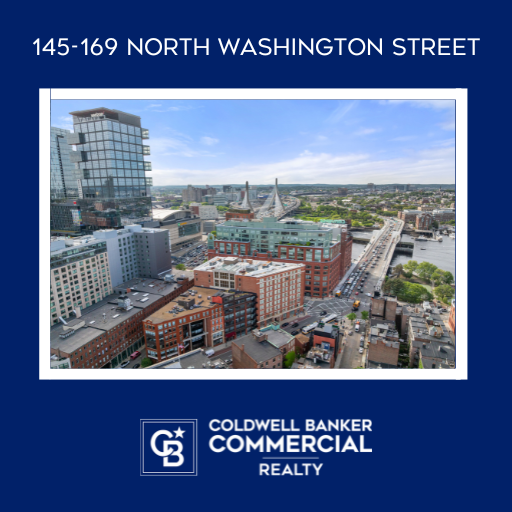

Explore a rare development opportunity at 145-169 North Washington Street in downtown Boston—over 6,000 sq ft of prime land with existing buildings and parking, ideal for residential, hospitality, or mixed-use projects in a AAA location.

Top Coldwell Banker Commercial broker Dan McGue closes two prime San Francisco apartment buildings for $19M, adding to his $3.3B+ career sales volume. Discover the details of these high-profile multifamily transactions.